Linking PAN Card with Aadhaar Card is now mandatory as per the Supreme Court Judgment and the Government directives. As per section 139AA of the Income-tax Act, 1961 (‘Act’), every person who has been allotted a Permanent Account Number (PAN) and is eligible to obtain Aadhaar number, must update his/her Aadhaar number to the Income Tax Department (PAN-Aadhaar Linkage). Linking the Aadhaar Number with PAN makes the e-Filing process easier, by eliminating the need of furnishing the Income Tax acknowledgment.

| Service | Linking of PAN and Aadhaar (Aadhar Card Link Pan Card) |

| Fee | ₹1000 |

| Requirement | PAN, Aadhaar and Online Payment Mode |

| Availability | Online |

| Last Date | 30th June 2023 |

Linking Permanent Account Number (PAN) with Aadhaar Number allows you to e-Verify your return using Aadhaar if your mobile number is registered with Aadhaar.

Further, as per Rule 114AAA of the Income Tax Rules, 1962, where a person fails to intimate his/her Aadhaar number as per section 139AA (2) of the Act, the PAN of such person shall become in-operative. The rule further states that owing to the PAN becoming in-operative, it shall be deemed that he/she has not furnished, intimated, or quoted the PAN, in accordance with the provisions of the Act, and the person shall be liable for all the consequences under the Act for not furnishing, intimating or quoting the PAN.

Recently the government has provided an option to link PAN Card with Aadhaar Card Number to eliminate the PAN Cards that are obtained fraudulently and those whose PAN Card is not linked with Aadhaar Number will soon get invalid or inoperative.

In line with aforesaid policies, every person eligible to obtain an Aadhaar and holding a PAN needs to intimate the Aadhaar to the income tax department. Non-linked PANs will be treated at par with person not having PAN. Following may be the primary implications for non-linking of PAN with Aadhaar.

Consequences for Skipping PAN Card Aadhar Link

| PAN will become inoperative | Pending refunds and interest on such refunds will not be issues |

| Application of higher rates of TDS under section 206AA of the Act | Application of higher rates of TCS under section 206CC of the Act |

| Transactions mandatorily requiring PAN under rule 114B may be restricted, subject to the provisions of said rules. |

Table of Contents

Benefits of Linking Permanent Account Number with Aadhaar

By linking your PAN with Aadhaar you will get the following benefits:

| Compliance Assurance | Ensure seamless utilization of your PAN Card by complying with applicable legal regulations, eliminating any potential inconvenience. |

| Effortless Verification and Submission | Easily e-Verify your return/forms, process refund re-issues, and engage in e-Proceedings using Aadhaar OTP |

| Secure Account Management | Enhance the security of your eFiling account by utilizing Aadhaar OTP, providing a robust layer of protection |

| Password Reset Convenience | Conveniently reset your account password using Aadhaar OTP, ensuring a secure and user-friendly experience |

| TDS Compliance | Adhere to the nominal TDS rate as applicable, with a reminder that non-linkage may result in a higher TDS |

| Hassle-Free Account Opening | Experience a smooth and hassle-free process when opening account |

| Efficient Financial Transactions | Financial transactions processed with ease |

| Streamlined Loan and Credit Card Applications | Benefit from a smooth and prompt processing of loan or credit card applications, ensuring a hassle-free experience |

So this guide will help you on How to Link PAN Card with Aadhaar Number, below are the several modes available with which you can get your PAN Card linked with Aadhaar Card Number.

Pan Card link Aadhar Card Information

| As per CBDT circular F. No. 370142/14/2022-TPL dated on 28th March 2023, person who has failed to intimate the Aadhaar number in accordance with section 139AA of the Income-tax Act, 1961 (the Act) read with rule 114AAA shall face the consequences of the PAN becoming inoperative. |

| The consequences of PAN becoming inoperative shall not be applicable to those persons who have been exempted from linking PAN-Aadhaar. |

| Taxpayers who have been allotted a PAN as on 1st July 2017 and are not exempted from linking are liable to pay a non-refundable fee of Rs. 1000 for submission of PAN-Aadhaar linkage request. If linking is not done till 30th June 2023, the PAN will be marked as inoperative with effect from 1st July 2023. |

| Please pay the applicable non-refundable fee of Rs. 1000 through e-Pay Tax service to proceed with submission of Aadhaar-PAN linking request. Click here for payment related information. |

| Please make sure fee payment is done under Minor head 500 – Other Receipts(500) and Major head 0021 [Income Tax (Other than Companies)] in single challan. |

Pan Aadhaar Link Last Date

New Pan Aadhaar link last date – June 30th 2023

Deadline for Linking PAN with Aadhaar

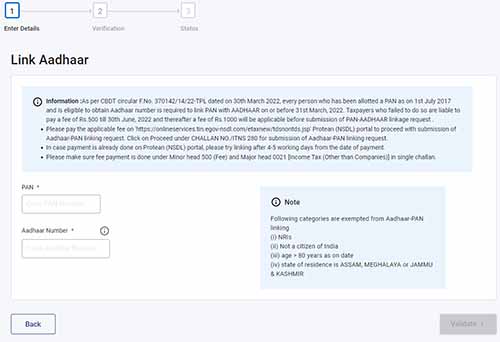

As per CBDT circular F.No. 370142/14/22-TPL dated on 30th March 2022, every person who has been allotted a PAN as on 1st July 2017 and is eligible to obtain Aadhaar number is required to link PAN with AADHAAR on or before 31st March, 2022. Taxpayers who failed to do so are liable to pay a fee of ₹500 till 30th June, 2022 and thereafter a fee of ₹1000 will be applicable before submission of PAN-AADHAAR linkage request .

Below is the message sent by bank as a reminder for Pan Card link Aadhar Card and the consequences of not linking.

Dear Customer, as per section 139AA of the Income Tax Act 1961, it is mandatory to link your Permanent Account Number (PAN) with your Aadhaar by 31-Mar-22. If not linked by 31-Mar-22, the PAN provided by you will become inoperative. Failure to link will also attract a higher TDS rate on interest earned and might also impact certain bank transactions where PAN is considered. Also, note that TDS once deducted cannot be refunded by the Bank under any circumstances.

Before we start with the linking process of PAN with Aadhaar Number let us know the requirements.

Requirements for PAN Aadhar link

To link your PAN Card with Aadhaar Number you will need PAN Card and Aadhaar Number, also the Aadhaar Number should have your active mobile number registered or else you won’t be able to do PAN Aadhar link.

Exemption Category for PAN Card Aadhar Card Link

Linking PAN Card Aadhar Card is not mandatory for specific set of categories.

| NRI (Non-Resident Indians) |

| Residents of the states of Jammu and Kashmir, Assam, and Meghalaya |

| A person aged 80 or more at any time during the previous year |

| A non-resident as per the Income-tax Act, 1961 |

| A person who is not a citizen of India |

How to link Aadhaar with PAN Card Online Step-by-Step

This process will be done through Income Tax PAN Aadhaar Link page. Don’t fall for any Aadhar card pan card link apps as incometax.gov.in is the only source from where you can get your Aadhaar linked with Pan.

To link your Aadhaar Number with PAN make sure you keep your Aadhaar Number and PAN Card Number in front of you

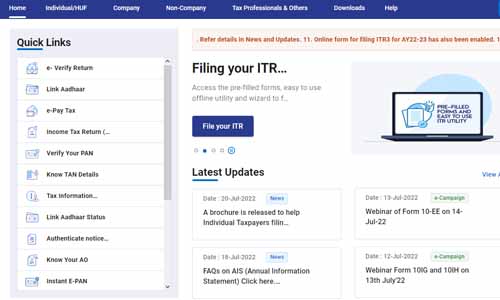

From your web browser just visit Income Tax India e-Filing Portal https://www.incometax.gov.in/

From homepage, under Quick Link Section click on Link Aadhaar

A new page Link Aadhaar will be loaded in which you will need to feed your PAN and Aadhaar Number to be linked and click on the Validate button

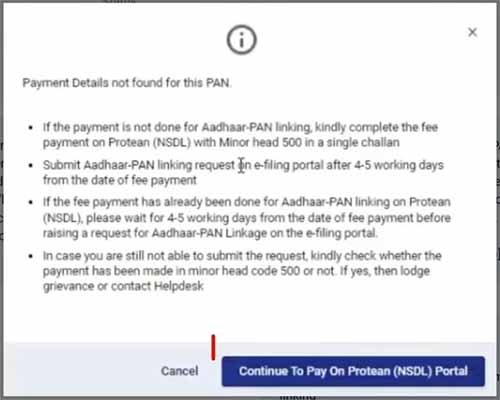

As the deadline of linking Aadhaar with PAN has been already passed, you will need to pay a fee, so a notification will appear “Payment details not found for this PAN“

Here you just need to click on the Continue to Pay On Protean (NSDL) Portal

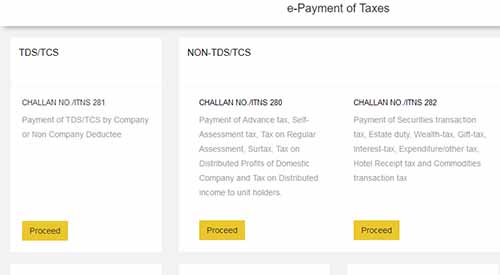

From the next page which is e-Payments of Taxes page, just click on option CHALLAN NO./ITNS 280 proceed button

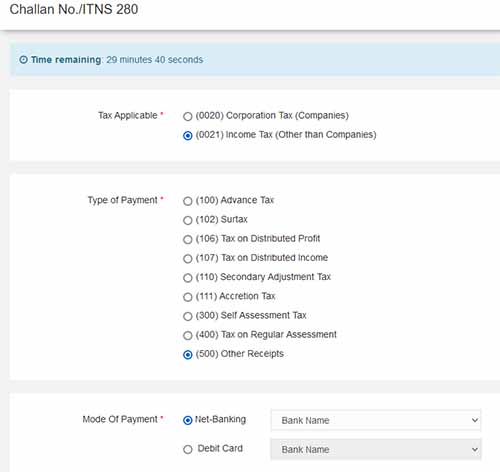

On next screen you will get a CHALLAN NO./ITNS 280 page, under Tax Applicable select (0021) Income Tax (Other than Companies) and under Type of Payment select (500) Other Receipts

Just scroll down the page and Select your mode of the payment from Net Banking or Debit Card and select the bank from which you would be paying the fee

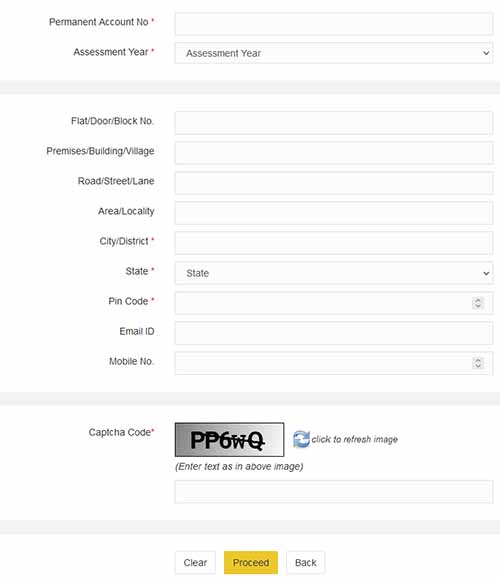

Next under Permanent Account No enter your PAN Number in Capital Letters

Select the Assessment Year and in below field enter the complete address, email id and mobile number

After entering all the above details, solve the Captcha Code and click on the Proceed button

On next page you will be asked to cross check the details which you have filled

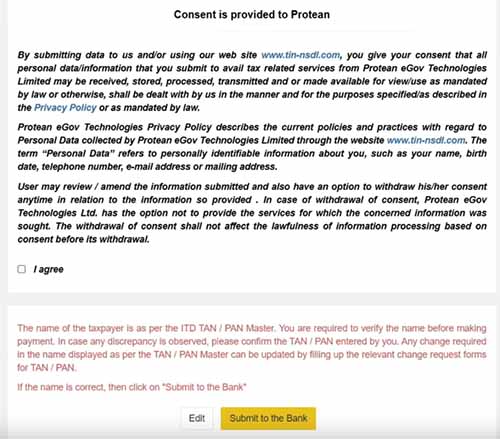

Just scroll down the page, and under consent section read the consent for which you will be agreeing and click on the I agree button and then click on Submit to the Bank button

The next page will take you to the gateway page, from where you can make selection of Payment option such as Net Banking or Debit Card

Once you make payment mode selection, just click on the submit button

Next you will need to complete the payment through whichever mode you have selected

Once you have done with payment successfully, come back to Income Tax India Homepage

Again click on Link Aadhaar under Quick Links

Enter your PAN, Aadhaar and click on validate button

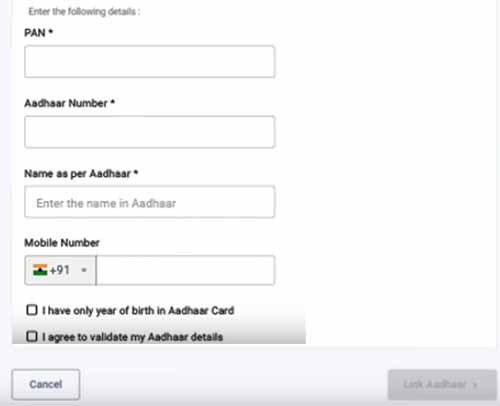

If you had successfully done the payment, then on next page you will be asked to validate by entering your name as per Aadhaar and mobile number

Once entering the details tick mark on I agree to validate my Aadhaar details and click on Link Aadhaar button

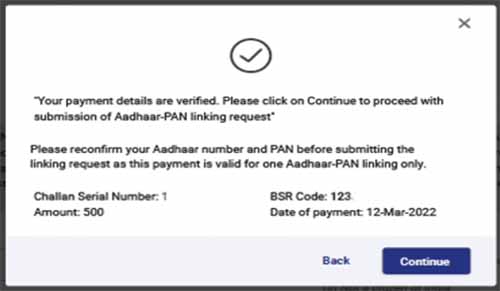

A prompt will appear “Your payment details are verified . Please Continue to proceed with submission of Aadhaar-PAN linking request”

Just click on the continue button appearing in that notification

A one-time-password will be sent on your registered mobile number

You will need to enter the received OTP in the enter OTP field and click on the Validate button

A message will appear, Your request for Aadhaar linking has been sent to UIDAI for validation. Please check the status later by clicking on ‘Link Aadhaar Status’

That’s it you have successfully linked your Aadhaar with PAN on Income Tax Indian e-Filing Portal.

Link Aadhaar Number to PAN Card using SMS

Linking Aadhaar Card to PAN Card is now mandatory, but not all people are familiar with the process on how to link Aadhaar Card to PAN Card. So Income Tax Department has recently started a new facility that allows an individual to link Aadhaar Card to PAN Card using SMS. Linking Aadhaar Card to Permanent Account Number using SMS will be suitable for all masses of people in India to get their Aadhaar Number linked to PAN in a hassle freeway.

Below is the SMS format which you will have to send to link Aadhaar Card to PAN Card using SMS.

| SMS Format to link PAN with Aadhaar using SMS |

|---|

| To link PAN with Aadhaar using SMS just type UIDPAN<SPACE><12 digit Aadhaar><Space><10 digit PAN> and send it to either 567678 or 56161 from your registered mobile number |

The above method can also be used as a pan aadhaar link status check by sms.

Alternatively, you can also visit the official Income Tax India e-Filing Portal to link the two identities. In case if there is a minor mismatch linking your Aadhaar Card to PAN via Online Portal will solve your problem. But if there is any minor mismatch in Aadhaar name, it will require Aadhaar OTP.

If you don’t get your Aadhaar linked with PAN than your PAN Card might go invalid anytime, so it is better to get your Aadhaar linked to PAN by following any of the methods. Also now Aadhaar is mandatory for new PAN Card Applicants, without that you can’t apply for PAN.

How to Link Aadhaar with PAN Card in Case of Mismatch

If your details differ in Aadhaar and PAN like name, gender, and date of birth then you will get mismatch error while linking your PAN Card with Aadhaar Card. So to successfully link your Aadhaar Number with PAN Card both details in documents should match, or else it will not allow you to link both.

So in such a situation how you can get your Aadhaar linked with PAN we will discuss in this article.

Link Aadhar with PAN in Case of Name Mismatch

In case if there is any minor mismatch in your Aadhaar Name than a one-time-password (OTP) will be sent on your registered Aadhaar Mobile Number.

And on entering that OTP Code only you will be able to proceed further to link your Aadhaar with PAN, but you should ensure that the Gender and Date of Birth matches in both the documents.

If in your Aadhaar Card your name is completely different from your name in PAN Card, then the Aadhaar Linking with PAN Card will get failed and you will be asked to change the name in either your PAN Card or your Aadhaar Card. So in such a case, you will have to get your PAN Card details updated by following link //www.utiitsl.com or update your Aadhaar Card Details.

And once the details get corrected and you receive acknowledgment about the correction from PAN or Aadhaar, you can proceed with linking your Aadhaar Number with your PAN Card.

Link Aadhaar with PAN Card in Case of Date of Birth or Gender Mismatch

- If your Date of Birth in PAN Card and Aadhaar Card doesn’t match then also you will not be allowed to link your Aadhaar with PAN Card. So in order to link Aadhaar with PAN Card, your demographics details should match on both your documents and for that, you will have to request an update in PAN Card by visiting //www.utiitsl.com and Update Aadhaar Card.

- So if you correct the details on both your Aadhaar Card and PAN Card, then you will be easily able to link your Aadhaar Card with PAN Card without any mismatch errors or problems.

The Government of India has made mandatory to link Aadhaar Number with PAN Card. And for the new applicants of PAN Card quoting 12 digit Aadhaar Number or Enrolment Number is necessary. So if you are guessing whether your Aadhaar Number is linked with PAN Card or not then there is a way to find out or make an inquiry to check if Aadhaar is linked with PAN Card.

Below is the full tutorial which will guide you on how to check if Aadhaar is linked with PAN Card.

Check if Aadhaar is linked with PAN Card

To check if your Aadhaar Number is attached with your PAN Card just visit the Official Income Tax India e-Filing portal by accessing URL https://www.incometax.gov.in/

From the Income Tax Department Homepage, just click on the Link Aadhaar Status option which is under Quick Links section

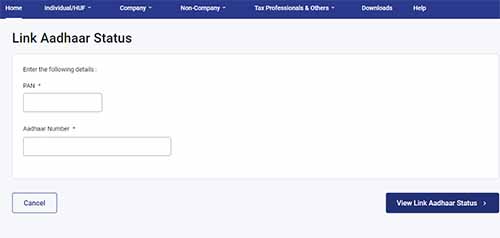

On this page, you will need to enter your PAN Card Number, Aadhaar Number and click on View Link Aadhaar Status

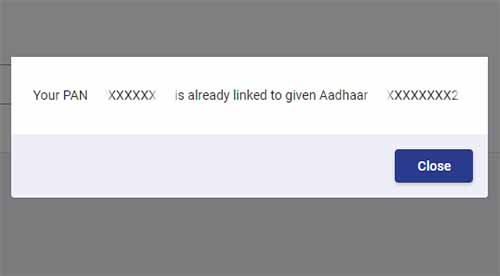

A prompt will appear with a message saying your Aadhaar Number is linked with PAN Card or not. If your Aadhaar Number is linked with Aadhaar then it will say “Your PAN XRXXXXXXA1 is already linked to given Aadhaar 91XXXXXXXX12”

OR

To check status of your Aadhaar PAN linkage, visit the official Income Tax Portal https://www.incometax.gov.in

From Quick Links, click on Link Aadhaar

Link Aadhaar will take you to link Aadhaar page, here you need to enter your PAN, Aadhaar Number and click on the Validate button

If your Aadhaar has been linked with PAN then a notification will appear “Your PAN TRXXXXXX5U is already linked to given Aadhaar 96XXXXXXXXXX” and if its not linked then it will take you to linkage process.

This is how easily you can find out whether your Aadhaar is linked with PAN Card (Permanent Account Number).

OR

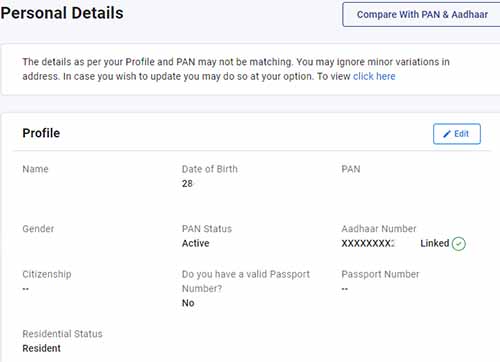

Alternatively, if you are filing your ITR and have registered an account on the incometaxindiaefiling.gov.in portal, just login into your account by entering your PAN Card Number, and Password.

Go to My Profile

Under Profile page, if your Aadhaar Number is linked with your PAN Card then it will display your Aadhaar Number, if not then you should get it linked as soon as possible.

If for some reason you can’t check online if Aadhaar is linked with PAN Card then you can also check it by sending an SMS.

Below is the SMS which you will have to compose from your registered mobile number to check if Aadhaar is linked with your PAN Card Number.

Type UIDPAN<SPACE><12 digit Aadhaar><Space><10 digit PAN> and send it to 567678 or 56161

If your PAN was already linked to your Aadhaar Number then you will receive a reply saying “Dear Applicant, your Aadhaar 123456789123 is already linked with your PAN CP123456 as per Income Tax records. You need not request again unless there is a change. We thank you for using our services. Regards, UTIITSL/ NSDL.”

How to Delink Aadhar from PAN Card

If you have linked incorrect Aadhaar Number with PAN or incorrect PAN with your Aadhaar, then you might be looking out for possible solutions on how to make corrections or how to delink Aadhar from PAN Card.

But unfortunately, there isn’t any option provided online on Income Tax efiling portal to delink Aadhar from PAN Card. However, linking incorrect Aadhaar with PAN or incorrect PAN with Aadhaar is not possible as the details on both documents should match to get the documents linked to each other. But still, If you have linked incorrect Aadhaar with PAN or incorrect PAN with Aadhaar then keeping quiet isn’t the solution.

To remove Aadhar number from pan card you will need to approach the concerned Income Tax Officer with a letter to delink or unlink Aadhaar from PAN and the letter should also mention the valid reason. And in case if you hold two PAN Card’s then you should surrender the extra one as you are breaking the law by holding two PAN Cards, as per provisions of Section 272B of the Income Tax Act., 1961, a penalty can be levied on possession of more than one PAN.

To surrender the PAN you will need to submit the PAN Change Request application form.

You should mention the PAN which you are using currently on top of the form. All other PAN/s inadvertently allotted to you should be mentioned at item no. 11 of the form and the corresponding PAN card copy/s should be submitted for cancellation along with the form.

You cannot link PAN with Aadhaar enrollment number. To link PAN with Aadhaar, 12 digits Aadhaar Number or UID is mandatory.

No, there isn’t any option provided on the Income Tax Department official website which allows delinking Aadhaar from PAN Card. Incase if you have linked wrong PAN with your Aadhaar or wrong Aadhaar with your PAN then you will need to approach Income Tax Officials with a request letter.

As Aadhaar is issued only to the individual, you will need to link Aadhaar of the karta that is principal person with the PAN Card.

You can visit the official income tax website and access the help section to reach out the aadhaar pan card link helpline number.

While trying to link Aadhar with PAN, mismatch msg comes… Could not do the linking